How Much Is Gift Tax On Property . If you gift a property to your husband, wife or civil partner, you do not have to pay. For tax purposes, a gift is anything of value that you give to someone else. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. gifting a property may require paying inheritance tax if you die within 7 years: property gifts and capital gains tax. It includes money, physical possessions and property. find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may be. you live for seven years after you give the property. do i pay tax if i am gifted a property? Your entire estate is under £325,000 (the inheritance tax allowance). the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on.

from www.slideserve.com

find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may be. you live for seven years after you give the property. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. It includes money, physical possessions and property. If you gift a property to your husband, wife or civil partner, you do not have to pay. do i pay tax if i am gifted a property? gifting a property may require paying inheritance tax if you die within 7 years: the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. For tax purposes, a gift is anything of value that you give to someone else. property gifts and capital gains tax.

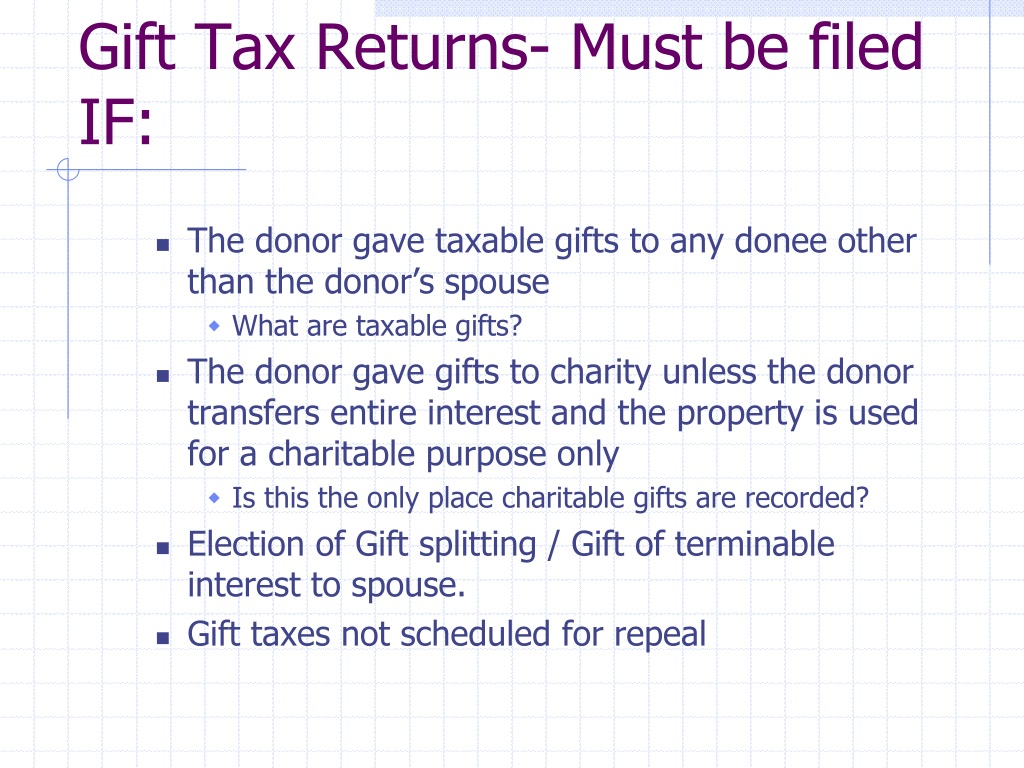

PPT Overview of Estate/Gift Tax Unified Rate Schedule PowerPoint

How Much Is Gift Tax On Property you live for seven years after you give the property. If you gift a property to your husband, wife or civil partner, you do not have to pay. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. gifting a property may require paying inheritance tax if you die within 7 years: property gifts and capital gains tax. find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may be. you live for seven years after you give the property. the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. Your entire estate is under £325,000 (the inheritance tax allowance). do i pay tax if i am gifted a property? It includes money, physical possessions and property. For tax purposes, a gift is anything of value that you give to someone else.

From www.zrivo.com

Gift Tax Rate 2023 2024 What Is It And Who Pays? How Much Is Gift Tax On Property If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. do i pay tax if i am gifted a property? property gifts and capital gains tax. It includes money, physical possessions and property. find out which gifts count towards the value of the estate, how to value them. How Much Is Gift Tax On Property.

From www.taxpolicycenter.org

How do the estate, gift, and generationskipping transfer taxes work How Much Is Gift Tax On Property For tax purposes, a gift is anything of value that you give to someone else. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. do. How Much Is Gift Tax On Property.

From www.personalfinanceclub.com

How to Perfectly Time The Market Personal Finance Club How Much Is Gift Tax On Property find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may be. you live for seven years after you give the property. property gifts and capital gains tax. It includes money, physical possessions and property. the current allowance is £325,000 and married couples can. How Much Is Gift Tax On Property.

From www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver How Much Is Gift Tax On Property the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. If you gift a property to your husband, wife or civil partner, you do not have to pay. Your entire estate is under £325,000 (the inheritance tax allowance). It includes money, physical possessions and property. . How Much Is Gift Tax On Property.

From apeopleschoice.com

Understanding Federal Estate and Gift Tax Rates A People's Choice How Much Is Gift Tax On Property gifting a property may require paying inheritance tax if you die within 7 years: Your entire estate is under £325,000 (the inheritance tax allowance). It includes money, physical possessions and property. property gifts and capital gains tax. do i pay tax if i am gifted a property? you live for seven years after you give the. How Much Is Gift Tax On Property.

From www.marottaonmoney.com

2017 Estate and Gift Tax Limits Marotta On Money How Much Is Gift Tax On Property property gifts and capital gains tax. the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. It includes money, physical possessions and property. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. you live. How Much Is Gift Tax On Property.

From www.financestrategists.com

Gift Tax Limit 2023 Calculation, Filing, and How to Avoid Gift Tax How Much Is Gift Tax On Property you live for seven years after you give the property. If you gift a property to your husband, wife or civil partner, you do not have to pay. It includes money, physical possessions and property. find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may. How Much Is Gift Tax On Property.

From andersonadvisors.com

How Much is the Gift Tax? What is a Gift Tax? Gift Tax Limit 2020 How Much Is Gift Tax On Property gifting a property may require paying inheritance tax if you die within 7 years: Your entire estate is under £325,000 (the inheritance tax allowance). find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may be. you live for seven years after you give the. How Much Is Gift Tax On Property.

From www.cbo.gov

Understanding Federal Estate and Gift Taxes Congressional Budget Office How Much Is Gift Tax On Property Your entire estate is under £325,000 (the inheritance tax allowance). you live for seven years after you give the property. find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may be. gifting a property may require paying inheritance tax if you die within 7. How Much Is Gift Tax On Property.

From www.makingyourmoneymatter.com

ES402 Introduction to Estate & Gift Tax How Much Is Gift Tax On Property If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. If you gift a property to your husband, wife or civil partner, you do not have to pay. you live for seven years after you give the property. the current allowance is £325,000 and married couples can combine theirs. How Much Is Gift Tax On Property.

From bethlynnandersenjd.com

Estate and Gift Tax 12 Things Those Transferring Millions Should Know How Much Is Gift Tax On Property If you gift a property to your husband, wife or civil partner, you do not have to pay. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. Your entire estate is under £325,000 (the inheritance tax allowance). For tax purposes, a gift is anything of value that you give to. How Much Is Gift Tax On Property.

From www.slideserve.com

PPT Overview of Estate/Gift Tax Unified Rate Schedule PowerPoint How Much Is Gift Tax On Property do i pay tax if i am gifted a property? the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. If you gift a property to. How Much Is Gift Tax On Property.

From www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation How Much Is Gift Tax On Property For tax purposes, a gift is anything of value that you give to someone else. gifting a property may require paying inheritance tax if you die within 7 years: Your entire estate is under £325,000 (the inheritance tax allowance). you live for seven years after you give the property. do i pay tax if i am gifted. How Much Is Gift Tax On Property.

From www.financestrategists.com

Lifetime Gift Tax Exemption Definition, Amounts, & Impact How Much Is Gift Tax On Property gifting a property may require paying inheritance tax if you die within 7 years: If you gift a property to your husband, wife or civil partner, you do not have to pay. If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. find out which gifts count towards the. How Much Is Gift Tax On Property.

From www.forbes.com

What Is The Gift Tax Rate? Forbes Advisor How Much Is Gift Tax On Property you live for seven years after you give the property. find out which gifts count towards the value of the estate, how to value them and work out how much inheritance tax may be. It includes money, physical possessions and property. If you gift a property to your husband, wife or civil partner, you do not have to. How Much Is Gift Tax On Property.

From estajuditha.pages.dev

Gift Tax For 2025 Ellyn Hillary How Much Is Gift Tax On Property do i pay tax if i am gifted a property? It includes money, physical possessions and property. If you gift a property to your husband, wife or civil partner, you do not have to pay. you live for seven years after you give the property. gifting a property may require paying inheritance tax if you die within. How Much Is Gift Tax On Property.

From www.financestrategists.com

Gift Tax Limit 2024 Calculation, Filing, and How to Avoid Gift Tax How Much Is Gift Tax On Property the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. property gifts and capital gains tax. For tax purposes, a gift is anything of value that you give to someone else. find out which gifts count towards the value of the estate, how to. How Much Is Gift Tax On Property.

From www.iwsadvisors.com

Gift and Estate Taxes Integrated Wealth Strategies, Inc. How Much Is Gift Tax On Property If your husband, wife or civil partner has gifted you property then you won’t have to pay inheritance tax. the current allowance is £325,000 and married couples can combine theirs to a total of £650,000 worth of assets to be passed on. Your entire estate is under £325,000 (the inheritance tax allowance). It includes money, physical possessions and property.. How Much Is Gift Tax On Property.